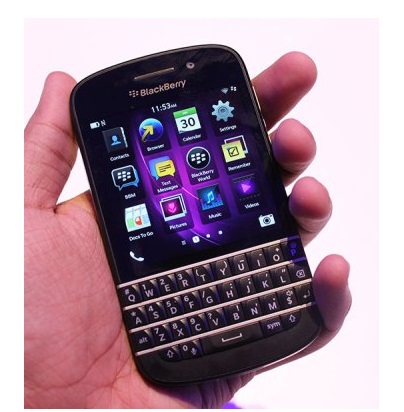

When the latest BlackBerry 10 platform and related hardware launch got hot in late 2012, BlackBerry’s stock price was able to bounce back after hitting a low around $6. Previously the Canadian company’ stocks used to trade above $140 in 2008 before it fell against competition from Samsung and Apple. However, now it’s been over two months that the latest BB10 hardware and software has been out in the market and a new QWERTY keyboard device, the BlackBerry Q10 is about to hit the stores but the stock price of the Waterloo-based company has not been able to achieve its lost glory, as currently it is trading around $16. Therefore, a majority of analysts still do not recommend investors buy shares of BlackBerry. In fact, those who had purchased shares on all time high or above $140 strongly advise others not to buy BlackBerry shares. On the other hand, there are some people who believe that buying BlackBerry’s shares at this stage is even better than before.

Some reports indicate that the brand is flourishing since it has introduced the new BB10 ecosystem, which is helping BlackBerry to attract more consumers than before. Mark Gomes has recently written in Seeking Alpha that “Third-party data from ChangeWave Research suggests that the stock price underestimates how much gas is left in BlackBerry’s tank,” he writes. For the second survey in a row, BlackBerry (7%) is registering a 3-pt uptick in planned buying.”

Gomes also said that, “In other words, over the next 90 days, 7% of buyers who plan to buy a smartphone plan to buy a BlackBerry. 7% doesn’t sound like much to write home about, especially considering that this number was likely closer to 40% a few years ago. However, a few years ago, 40% was enough to justify a $150 share price.”

Here is the explanation for the 7 percent add up in the $15 stock:

“First, looking at total worldwide demand, according to Gartner Group there were 207.7 million smartphones sold in Q4 of 2012 (up 38% versus Q4 of 2011. If another 200 million phones sell over the next 90 days, 7% share would represent 14 million BlackBerry smartphones.”

Gomes has also indicated that to the extent lucrative companies go, “some of BBRY’s current metrics are sitting at levels that have historically been very favourable for investors.”

“Its market cap is $7.5 billion, but with nearly $3 billion in cash, its enterprise value is just $4.5 billion ($8.75 per share). That gives it an EV/R&D ratio of 3, which puts it among the lowest 1% of profitable public companies. From an earnings perspective, if the company achieves $3.00 in EPS, an enterprise P/E of 8 would give it a $24 EV. Add back the net cash and we’re looking at a $30+ stock.”

On the whole, Gomes is of the view that the stock of Blackberry is going to hit $20 per share mark in the “coming months”. In addition, he thinks that it has a tremendous potential to even hit $30 during this year.

Source: TechVibes

Photo: TechCrunch